how to reduce taxable income for high earners 2020

Bonuses that are more lucrative. People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains.

How Is Taxable Income Calculated

Make a donation to charity Ensure your retirement is as healthy as possible.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. To start with ensure the pay you pay them is sensible. A donor-advised fund DAF is an investment account created to support charitable organizations. Making some strategic purchases could help reduce your taxable income although dont go spending just for the sake of it and check with your accountant before you commit a large amount of money with the idea that you can write it off.

Their pay will likewise fill in as a business tax conclusion for you bringing down your taxable income. You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except for Roth IR As and Roth 401 ks. So if you rent it out to strangers you could save some taxes there.

Thats why its one of the most popular tax reduction strategies. For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower. Tax on 6500 of Qualified Dividends.

Refundable Child Tax Credit-1286. In 2020 you can. Thats a tax saving between 9360 24 marginal rate and 14430 37 marginal rate.

Contributions to traditional 401 k and IRA. If youre a high-income earner wanting to reduce your taxable income start with these five strategies. Sell short at the highest price.

How do high income earners reduce taxes. Make deductions faster and defer income. Most employers will give you the option of a pre-tax or a Roth 401k.

From Simple To Complex Taxes Filing With TurboTax Is Easy. To reduce your reportable income you should start with maxing out your pre-tax 401k. Here are five tax saving tips that are easy to apply.

The same donation amount will help the high-income earner save 185 in taxes while the taxpayer in the 10 tax bracket will save only 50. Take precautions so that you arent d credit. Income protection is tax deductible.

Grab a 0 tax rate on gains. High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. A Roth retirement account has its own benefits but it wont reduce your income this year.

For the 2020 tax year you can contribute up to 6000 to an IRA or a total of up to 6000 can be divided among multiple accounts plus an. According to the ATO. Giving money to non-profit organizations has long been a way for the wealthy to get a deduction on their taxes.

A married couple can reduce taxable income by 39000. There are a couple of things to remember with this strategy. Just renting your house to your business for up to 14 days per year.

Make changes to W-4 withholding. Establish retirement accounts One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Max Out Your 401k The contribution limit for an individual in 2021 is 19500.

Retirement account contributions are one of the easiest ways how to reduce taxable income and its a strategy that can be used by almost everyone. Foreign Income Tax Credit-300. How to Reduce Taxable Income.

Keep careful records on this one but basically youre allowed to rent your house out to anyone you like including your own business without paying taxes on that rental income. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered. How Can I Reduce My Taxable Income 2021.

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of. Consider a 500 donation from a high earner in the 37 tax bracket and a similar donation amount from a taxpayer in the 10 bracket. Max your pre-tax 401k.

6 Tax Strategies for High Net Worth Individuals 1. Volunteering expenses are deductible too. With a DAF you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time.

And under the new tax law the amount you can deduct has. With the new tax plan the first 12000 will be sans tax for your worker kid in view of the new standard derivation. Every high-income earner should have a plan to diversify the taxation of income in retirement.

There are many strategies to help you maximize your charitable contributions and reduce your income tax. You have to pay for the FSA. How to reduce taxable income for high earners through your employer benefits.

For taxable accounts a tax-efficient index mutual fund andor ETF may help reduce the taxes you pay on your investments year-to-year. An employee can contribute up to. A flexible spending account FSA provides a way to reduce taxable income by setting aside a portion of earnings in a separate account managed by an employer.

THE TAX BURDEN ON HIGH INCOME The tax consequences of high income THE POWER OF YOUR PENSION How you can use pension contributions to reduce your tax bill SELF-INVESTED PERSONAL PENSIONS SIPPS The investment option that lets you control how and where your money is invested PENSION WITHDRAWALS The tax-efficient way to access your money when. If thats you be ready to sell some winning funds later in the year even if. In 2020 you can deduct up to 300 of qualified charitable cash.

What Is Taxable Income With Examples Thestreet

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How Do Marginal Income Tax Rates Work And What If We Increased Them

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

6 Strategies To Reduce Taxable Income For High Earners

Tax Strategies For High Income Earners Wiser Wealth Management

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The 4 Tax Strategies For High Income Earners You Should Bookmark

How Do 401 K Tax Deductions Work

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

What Is Taxable Income And How To Calculate It Forbes Advisor

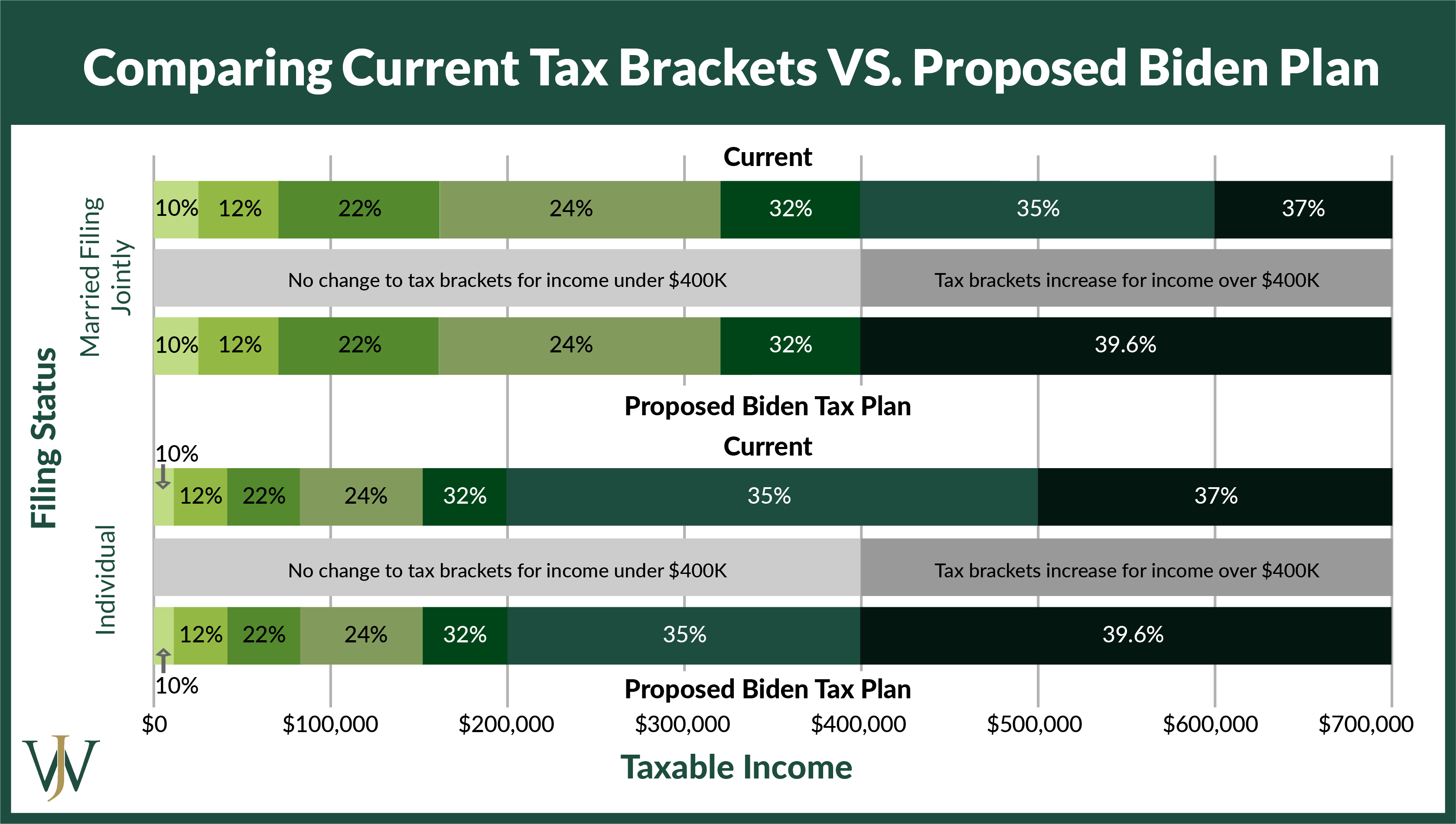

Biden S Tax Plan Explained For High Income Earners Making Over 400 000